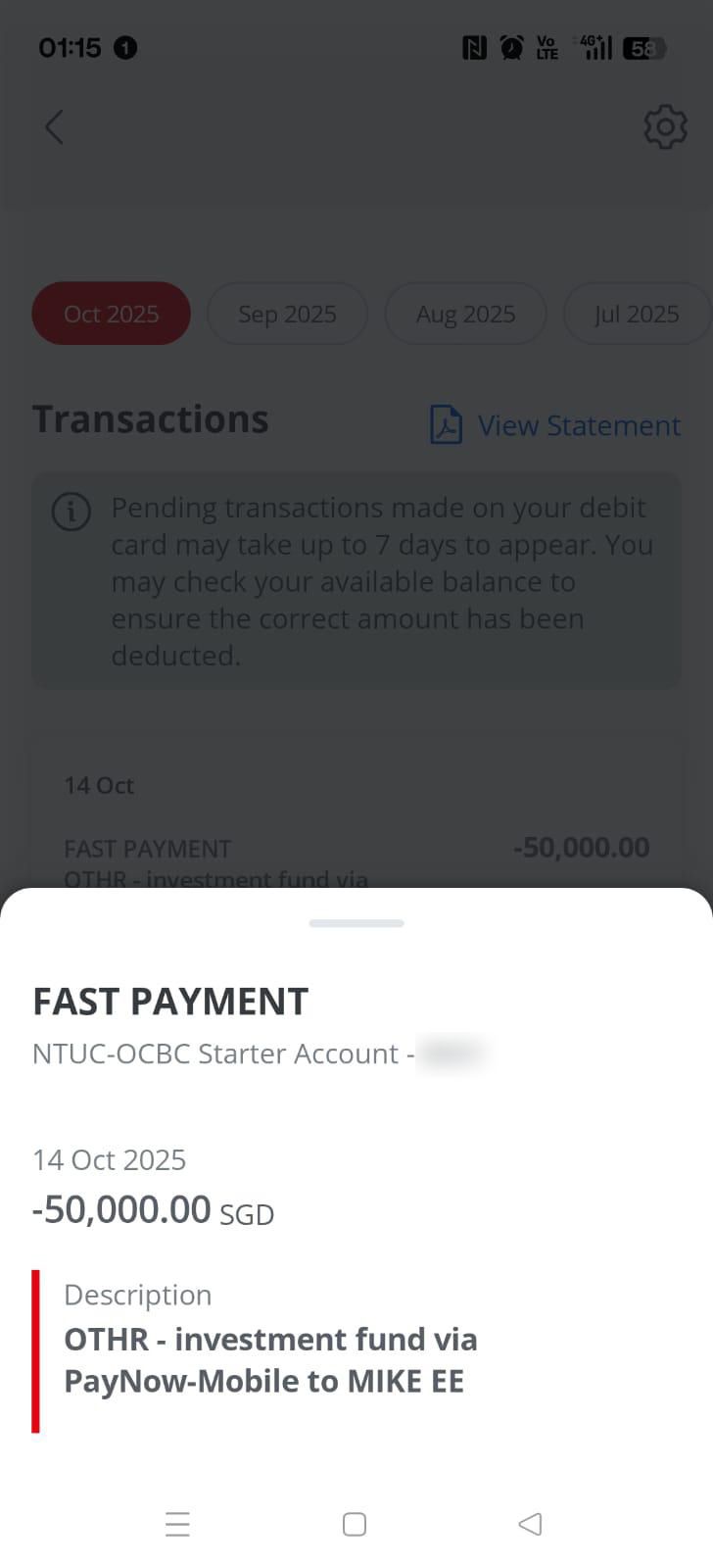

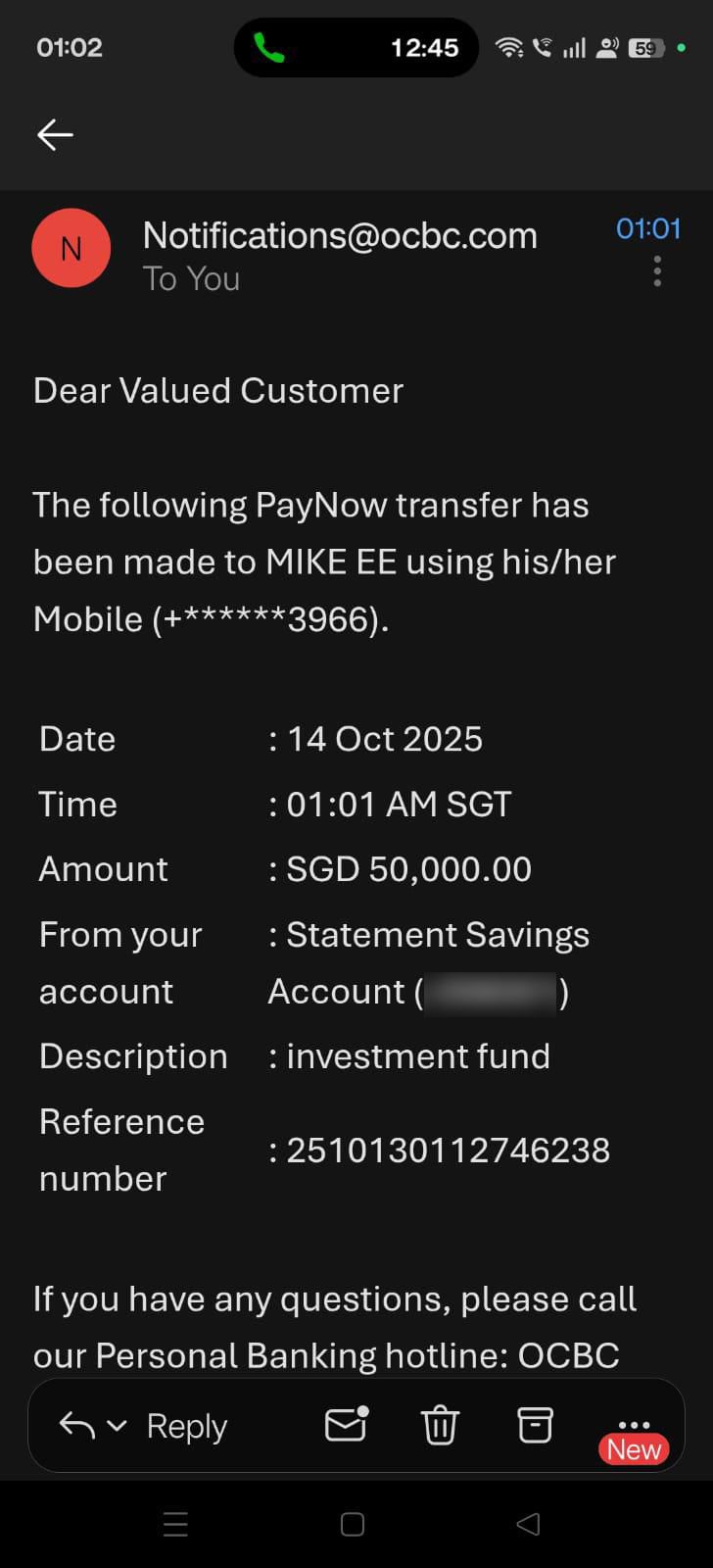

At Assured Debt Recovery, we frequently assist clients who have encountered financial loss due to misplaced trust or informal lending arrangements. In this particular case, our client had extended a personal loan of $50,000 to a close acquaintance who claimed to be starting a new business venture.

The funds were represented as an investment opportunity in a “new company,” with promises of attractive returns. However, after several months with no updates or evidence of business progress, the client discovered that the company was, in fact, an empty shell. The money had been diverted for personal use, and all attempts to communicate with the borrower were ignored.

The client faced significant difficulty recovering the funds due to the absence of formal corporate structures and the breakdown of personal communication. By the time the client approached Assured Debt Recovery, the debtor had ceased all contact, and no voluntary repayment had been made.

Our primary challenge was to recover the full $50,000 while avoiding the time, cost, and public exposure associated with legal proceedings. The client sought a professional, discreet, and lawful debt recovery solution in Singapore that would yield results without escalating the matter unnecessarily.

At Assured Debt Recovery, we adopt a structured, compliance-driven process that ensures each case is handled with professionalism and integrity.

Comprehensive Case Assessment

Our team conducted a detailed review of all available documentation, including bank transfer records, written messages, and informal loan agreements. This allowed us to verify the legitimacy of the claim and build a strong factual foundation for the recovery process.

Evidence-Based Communication

Using verified documentation, we issued formal written correspondence to the debtor outlining the outstanding amount, the basis of the claim, and the client’s expectation for prompt repayment. This professional yet firm approach established accountability while maintaining respect and compliance with Singapore’s debt collection regulations.

Persistent Negotiation and Mediation

Our experienced debt collectors in Singapore maintained consistent follow-up with the debtor, leveraging clear communication and negotiation strategies to achieve cooperation. Rather than resorting to litigation, we focused on facilitating a mutually acceptable repayment solution that ensured full restitution for our client.

Through a combination of persistence, tact, and professional handling, Assured Debt Recovery successfully recovered the full $50,000 on behalf of our client. The entire recovery process was completed without initiating court action, demonstrating the effectiveness of a structured and compliant negotiation strategy.

The client received full repayment and expressed satisfaction with the outcome, particularly appreciating our discretion, professionalism, and efficiency.

This case underscores the importance of engaging a licensed and professional debt collector in Singapore when dealing with personal or business loan disputes. With our experience in evidence-based negotiation and our commitment to regulatory compliance, Assured Debt Recovery continues to provide effective debt recovery solutions for individuals and corporations alike.

If you are facing a similar situation — whether involving unpaid personal loans, business debts, or investment disputes — our team can provide a confidential and results-driven debt recovery service tailored to your needs.

Contact Assured Debt Recovery, your trusted debt collector in Singapore, to discuss how we can assist in recovering what is rightfully yours.